Pizza Hut vs. Domino’s - A Clash of Crusts

The strategic divide that reshaped the pizza industry

It’s February 8, 1968, in Ypsilanti, Michigan, and Tom Monaghan’s life is on the verge of collapse, again. Racing through the town’s snow-covered streets in a beat-up delivery car, he sees the orange glow of fire reflecting off the windows of shuttered buildings. His heart sinks as he reaches the source of the light: Domino’s headquarters is engulfed in flames. The fire, spreading rapidly through the wooden structure, is consuming not just the building but the fragile stability Monaghan had fought to achieve over the last six years.

For Monaghan, Domino’s wasn’t just a business but his lifeline. When his brother left, he’d inherited the company’s struggles, trading his share for a Volkswagen Beetle. Since then, Monaghan had faced every imaginable setback: debt, betrayal, and near bankruptcy. His life had become a relentless fight to survive, driven by a vision of creating something as iconic as McDonald’s. As he watches the flames devour his dream, he wonders if this is the final blow.

Pizza’s rise in America was as unlikely as Monaghan’s journey. Born on the streets of Naples, the dish was humble, cheap, portable, and straightforward. By the mid-20th century, it had made its way to American cities through Italian immigrants. But outside the ethnic enclaves of Little Italy, pizza was largely unknown until returning soldiers from World War II brought home a taste for it. Soon, this street food began evolving into something distinctly American, fueled by experimentation and the pursuit of convenience.

In 1958, two brothers in Wichita, Kansas, Dan and Frank Carney, opened a modest pizzeria in a small brick building. With just $600, they launched Pizza Hut, a business defining the Midwest’s love affair with pizza. They were inexperienced and underprepared, relying on an incomplete recipe for French bread as a substitute for proper pizza dough. Yet, the simplicity of their operation, thin crusts, familiar toppings, and an inviting name, struck a chord with locals.

The Carney brothers’ timing was perfect. Pizza’s popularity surged on the coasts, and Wichita had no competition. Word of mouth spread quickly, and by the end of their first year, Pizza Hut was raking in $1,000 a week. Encouraged, they began franchising, offering friends the chance to open a Pizza Hut for a nominal fee. It was an expansion model that would ignite rapid growth and plant the seeds of future challenges.

Meanwhile, Monaghan and his brother Jim accidentally stumbled into the pizza business in Michigan. The two bought a struggling pizzeria near a college campus, betting that late-night demand from students would keep them afloat. At first, it was a side hustle, with Jim keeping his day job as a mailman. But the work proved gruelling, and Jim left Tom to manage the business within a year.

With no formal training or support, Monaghan learned the ropes through trial and error. He experimented with everything, from recipes to delivery logistics, always searching for ways to save time and money. In 1965, he decided to rebrand the business as Domino’s and focus exclusively on delivery. It was a radical move. At the time, few restaurants offered delivery, and none had streamlined it into a core service. But Monaghan believed delivery was the future, a way to differentiate Domino’s from competitors and capitalise on the growing convenience trend.

Monaghan’s obsession with speed led to innovations that became the backbone of Domino’s success. He introduced corrugated cardboard boxes to replace flimsy cake boxes, ensuring pizzas stayed warm and intact during transit. He simplified the menu, stripping it to essentials, and reconfigured kitchen workflows to shave seconds off preparation time. These changes allowed Domino’s to promise something revolutionary: pizza delivered in 30 minutes or less.

As Domino’s refined its delivery model, Pizza Hut expanded rapidly across the Midwest. The Carneys began creating a unified brand identity inspired by McDonald’s success. They hired architects to design the iconic red-roofed buildings that became synonymous with Pizza Hut and launched their first television ads. By the late 1960s, Pizza Hut had grown into a regional powerhouse, with dozens of locations and a growing reputation for consistency and quality.

But success brought new challenges. Competitors like Shakey’s Pizza, a California-based chain with a quirky mix of Italian food, German beer, and Dixieland jazz, were racing to claim market share. The Carneys realised that to stay ahead, Pizza Hut needed to formalise its operations. They introduced detailed manuals for franchisees and began emphasising standardisation, a strategy that would become a hallmark of the brand.

For Pizza Hut and Domino’s, these early years were defined by scrappiness and experimentation. The Carneys built their empire through community connections and grassroots marketing, while Monaghan relied on sheer willpower and relentless focus. Yet, their paths converged, setting the stage for a rivalry that reshaped how America ate pizza.

By the end of the 1960s, Pizza Hut had a firm grip on the dine-in market, while Domino’s was rapidly becoming synonymous with delivery. Each had found its niche, but the competition was far from over. As the industry matured, new challenges, technological innovation, changing consumer habits, and the rise of third-party delivery apps, would test their ability to adapt.

For now, though, the foundations were laid. Pizza was not just an ethnic food or a novelty but a national obsession. And for Pizza Hut and Domino’s, the race to the top was just beginning.

The Breaking Point

It’s January 1969 in Wichita, Kansas, and the atmosphere in Pizza Hut’s headquarters is thick with anticipation. Co-founder Dan Carney stands at his desk, juggling a phone call with his stockbroker while the room fills with nervous chatter from executives and franchisees. Dan and his brother Frank decided to take the company public a year ago, hoping the move would fund their ambitious expansion plans. But as the stockbroker reads out the results of Pizza Hut’s first trading day, Dan realises they’ve set in motion forces far more significant than they could control.

“The stock opened at $11 and closed at $32,” Dan announces, almost in disbelief. For a moment, the room is silent as the news sinks in. Then, chaos erupts, franchisees who had swapped their businesses for shares, cheer and hug. Champagne bottles are popped, cigars are lit, and laughter echoes. Many of them, including Dan, have just become millionaires on paper. But beneath the celebration lies a ticking time bomb.

To fuel its IPO, Pizza Hut absorbed a staggering number of franchises, many of which operated with varying levels of efficiency and accountability. The Carneys had promised Wall Street growth, but integrating these diverse operations took a lot of work.

Two months later, Dan Carney sits across from the company’s new financial controller, Dan Taylor, at a steakhouse in Wichita. Taylor, haggard and visibly stressed, delivers the grim news. “Honestly, it’s bad, awful,” he says. “We’ve gone from managing 14 restaurants in two states to over 130 in 20 states, and none of them report their finances the same way.”

Taylor explains that the lack of standardisation has prevented the company from tracking its cash flow. Worse, many former franchisees, now company employees, continue to act independently, taking out loans under the Pizza Hut name without approval from headquarters. The $5 million raised in the IPO is gone, spent in less than two months, leaving the company technically bankrupt.

Dan is stunned. He was riding high on Pizza Hut’s IPO success just weeks ago. Now, the business he and his brother built from scratch teeters on the brink of collapse. But Dan is nothing if not resilient. “We’ll fix it,” he insists, though the path forward is anything but straightforward.

Over the next year, Pizza Hut’s leadership embarked on a gruelling effort to stabilise the company. They imposed strict financial controls, requiring weekly standardised reports from every store and halting unauthorised loans. Managers were retrained to align with the company’s centralised vision, and Carneys invited external board members to hold them accountable. Slowly but surely, these changes took effect. By 1970, Pizza Hut was back in the black, with profits rising steadily.

The turnaround bolsters the Carneys’ confidence and exposes a more profound challenge. As Pizza Hut grows, so does the competition. Regional chains like Godfather’s and Little Caesars are gaining traction, while a scrappy Michigan-based rival called Domino’s begins to make waves with its focus on delivery.

Meanwhile, Domino’s founder, Tom Monaghan, grapples with an existential crisis. By 1969, Domino’s was mired in debt, struggling to recover from the devastating fire that destroyed its headquarters the previous year. Tom had banked on an IPO to save the company, but the plan fell apart when financial irregularities were discovered. To make matters worse, his strategy of expanding into suburban neighbourhoods, far from the college campuses that drove his initial success, had backfired. Suburbanites simply didn’t order enough delivery pizza to sustain the business.

In the summer of 1970, a debt collector arrives at Domino’s makeshift headquarters, a ramshackle steel Quonset hut in Ypsilanti, Michigan, and seizes Tom’s truck as partial repayment. It’s a humiliating moment, but it also serves as a turning point. Tom realises that survival will require not just grit but ingenuity.

Later that year, Domino’s introduced a bold new promotion: Super Sunday, offering 12-inch pizzas for just $1. The idea is risky, especially given the company’s precarious financial state, but the response is overwhelming. One night, a single Domino’s store sells over 2,000 pizzas, generating three days’ revenue. The promotion is a logistical nightmare, with delivery times exceeding an hour and wrong orders piling up, but the financial windfall is undeniable. Tom sees its potential immediately. “This could save us,” he tells his team. And it does.

As the 1970s progressed, Domino’s refined its operations and began to claw its way out of debt. Monaghan emphasises efficiency, training managers to prepare pizzas in under 30 seconds and ensuring that every store operates like a well-oiled machine. By the end of the decade, Domino’s was on solid ground, focusing on fast, reliable delivery and positioning itself as a formidable challenger to Pizza Hut.

For Pizza Hut, the stakes are higher than ever. To maintain its growth, the company begins exploring new opportunities, from international expansion to diversifying into other fast-food concepts. But these experiments, including a taco chain and a steakhouse, need to gain traction. By the mid-1970s, Pizza Hut realised that its future lies not in diversification but in doubling down on what it does best: pizza.

In 1977, Pizza Hut merged with PepsiCo, accessing the conglomerate’s vast resources and marketing expertise. The partnership propels Pizza Hut into a new era and sets the stage for an intensifying rivalry with Domino’s.

As the 1980s approached, the pizza wars were heating up. Both companies have weathered near collapse and emerged more muscular, but their paths to success could not be more different. Pizza Hut, with its emphasis on dine-in experiences, is the establishment. Domino’s, lean and disruptive, is the insurgent. The question isn’t just who makes the better pizza, it’s who can adapt faster in a rapidly changing industry.

Delivering the Edge

It’s fall 1979, and Pizza Hut’s Test Kitchen in Wichita, Kansas, is alive with a blend of cautious optimism and simmering scepticism. Frank Carney, the chain’s CEO, stands before a gathering of franchisees, poised to reveal a culinary innovation three years in the making. He gestures toward a refrigerated cabinet, opening it to unveil a black pan cradling dough, a concoction that had been fine-tuned to perfection under precise temperature and humidity controls. Carney’s voice carries a mix of conviction and hope: “This is the Sicilian pan pizza,” he declares. “It’s the game-changer we’ve been waiting for.”

The audience, however, isn’t convinced. Memories of a previous misstep, the taco pizza, are still fresh in their minds, and scepticism hangs heavy in the air. Carney soldiers on, layering sauce, cheese, and toppings onto the dough, painting a delicious picture of a future where this pizza will unite thin-crust and thick-crust enthusiasts under one roof. Yet the murmurs of concern persist. The cost implications of additional pans, spatulas, and cork pads weigh on the franchisees. One finally speaks up, voicing the collective anxiety: “Frank, our stores are struggling. Why add more expenses?”

Carney counters with figures that stop the conversation in its tracks, test markets have shown a sales increase of up to 100%. Numbers this compelling quickly shift the mood. A year later, Pizza Hut’s pan pizza takes the nation by storm, reinvigorating the brand and recapturing market share from competitors. But as Pizza Hut basks in its resurgence, a storm is brewing on the horizon. Domino’s Pizza, lean and ambitious, is preparing to redefine the game entirely.

By 1980, Tom Monaghan, the founder of Domino’s, finds himself in a place he had dreamed of for years: the office of Ray Kroc, the mastermind behind McDonald’s success. Monaghan had spent almost a decade seeking this meeting, convinced that Kroc held the keys to scaling a fast-food empire. Now, sitting across from his idol, Monaghan eagerly explains Domino’s unique formula, simple menus, rapid delivery, and a tightly controlled franchise model. Kroc, listening intently, offers a piece of advice that Monaghan finds both surprising and transformative. “Expansion is good,” Kroc says, leaning forward, “but the real challenge isn’t growth, it’s maintaining quality while doing it.”

This wisdom falls heavily on Monaghan. For years, he had chased numbers, more stores, customers, and deliveries. However, Kroc’s words crystallised a principle that would shape Domino’s strategy. Monaghan doubled down on his approach to scaling successfully: a rigorous system ensuring that every new franchise operates with the precision of the original store.

Meanwhile, Pizza Hut faces an existential dilemma. With its promise of hot pizza at your door in 30 minutes, Domino’s is eating into market share, particularly in suburban neighbourhoods where two-income families crave convenience. Within Pizza Hut’s boardrooms, a fierce debate ensues. Once considered an afterthought, delivery is now seen as both an opportunity and a threat. Executives worry that venturing into delivery might cannibalise their dining-in business, undermining the very foundation of their brand.

Steve Reinemund, a rising star in the company, proposes a cautious but decisive approach: pilot delivery-only locations under corporate control. The goal is to gather data without risking franchisee relationships. As these experiments roll out, Pizza Hut learns hard lessons, fax machines for taking orders become bottlenecks, and customer expectations for speed rival those of a New York minute. Yet, the data also reveal a crucial insight: delivery and dine-in attract distinct audiences. Bolstered by these findings, Pizza Hut begins its slow but steady march into the delivery market.

By the mid-1980s, the competition between these two giants reached a fever pitch. Fueled by Kroc’s mentorship, Monaghan drives Domino’s to expand at breakneck speed, opening hundreds of new locations each year. He invests heavily in marketing, plastering the promise of 30-minute delivery across every medium imaginable. Still finding its footing in the delivery space, Pizza Hut scrambles to keep up.

The rivalry between Pizza Hut and Domino’s isn’t just a battle of pizzas, it’s a clash of philosophies. Where Domino’s thrives on speed and simplicity, Pizza Hut leans on its legacy of quality and innovation. The stakes are high, and both companies know that the winner will shape how America eats pizza for decades.

The Turning Point

It’s October 1985, and at a car auction in Dearborn, Michigan, Tom Monaghan sits with the poise of a man who knows he’s arrived. Monaghan, the founder of Domino’s Pizza, now a billion-dollar enterprise, has spent the day indulging in his latest obsession: collecting vintage cars. Monaghan’s hand wavers as the auctioneer announces bids for a rare Lincoln K Convertible once driven by royalty. He locks eyes with a rival bidder, a dealer from Arizona, but hesitates as his assistant whispers a warning: “Tom, you’ve already spent $200,000 today.”

For once, Monaghan yields, watching as the Arizona dealer claims the car for $210,000. “You could have gone higher,” his assistant says. Monaghan shakes his head with a smile. He knows he could have outbid anyone in the room ten times over, but he feels a rare surge of restraint. Perhaps it’s because Monaghan understands what it took to reach this moment: years of scrapping and clawing his way out of poverty, first as a boy abandoned to an orphanage and later as a young entrepreneur fending off debt collectors and creditors. Yet, there’s a dissonance between the rags-to-riches story he wears proudly and the path he’s now on, a path paved with ostentatious wealth and unchecked ambition.

Even as Monaghan indulges in personal triumphs, Domino’s is fighting a battle on multiple fronts. Pizza Hut, buoyed by its dominance in the dine-in market, is slowly turning its gaze toward delivery, a domain Domino’s has mastered but cannot afford to monopolise complacently. For Pizza Hut, adding delivery to its operations is fraught with challenges. Franchisees, wary of risking their dine-in revenue, remain sceptical. Yet the company’s leadership knows that failure to act decisively could hand Domino’s a permanent advantage.

Steven Reinemund, the newly appointed CEO of Pizza Hut, understands the stakes. In a critical meeting with the company’s top franchisees, he presents data showing that delivery is not merely a convenience but a necessity for future growth. “We’ve tested 280 delivery stores,” he explains, pointing to slides. “The results show promise. Delivery sales complement rather than cannibalise our dine-in revenue.” His tone is measured but firm; he knows convincing this audience won’t be easy.

A franchisee from the Pacific Northwest speaks first. “Your numbers look good,” he says, his scepticism softened. I’ll open one delivery unit in my territory and see how it performs.” Others murmur in agreement, but not everyone is swayed. A voice from the back cuts through the cautious optimism: “Why should we spend our money testing this when the risk is all on us? If a corporation wants delivery, let them foot the bill.”

Reinemund’s face tightens. The resistance is expected but no less frustrating. Without unified support, Pizza Hut’s rollout of delivery stores will lag, giving Domino’s an even more excellent head start. Yet, Reinemund knows that pushing too hard risks alienating his franchisees entirely.

Meanwhile, Domino’s is sharpening its edge. In September 1986, the company launched a bold advertising campaign featuring “Noid,” a quirky claymation character who personifies all the frustrations of lousy pizza delivery. “Avoid the Noid,” the ads proclaim, driving home Domino’s promise of hot, fresh pizza within 30 minutes. Kids adore the Noid; parents are bombarded with requests for Domino’s. Sales skyrocket as the campaign captures the national imagination.

Now fully committed to delivery, Pizza Hut begins a $650 million expansion to level the playing field. In 18 months, it grew from 400 delivery units to more than 1,700. Every day, new Pizza Hut locations begin delivering, closing the gap with Domino’s. But Domino’s is feeling the strain of its rapid growth. In addition to external competition, internal tensions begin to surface.

Monaghan, once a hands-on leader, has become increasingly distant from the day-to-day operations of Domino’s. His extravagant purchases and public stances, including a divisive position on abortion, alienate franchisees. Some grumble that Monaghan has lost touch with the gritty realities of running a pizza store. “You’ve got to let us adapt,” one franchisee argues during a tense meeting. “Pizza Hut offers pan pizza, Diet Coke, and breadsticks, why can’t we?”

But Monaghan resists. “Simplicity is our edge,” he insists. It’s how we guarantee 30-minute delivery. Complicating the menu will slow us down.” The franchisees leave frustrated and feeling unheard.

By 1989, Domino’s signature 30-minute guarantee became a liability. A series of fatal accidents involving drivers prompts lawsuits and media scrutiny. Critics argue that the company’s emphasis on speed encourages reckless driving. Monaghan, however, seems distracted by a more personal crisis.

Late one night in 1989, Monaghan finds himself unable to sleep. He picks up a book from his nightstand: Mere Christianity by C.S. Lewis. One passage strikes him with the force of a revelation: “Pride is spiritual cancer.” For Monaghan, it’s a mirror to his life, a life of showmanship and unchecked ambition. Overwhelmed, he decides to sell Domino’s and devote his wealth to Catholic causes.

By 1990, Monaghan’s vision for a quick sale falters. The company’s mounting debt and Monaghan’s indulgent spending scare off potential buyers. In the meantime, Pizza Hut continues to erode Domino’s market share. Monaghan, disillusioned but determined, steps back into the CEO role to clean up the mess, sell assets and streamline operations. But as Domino’s regains its footing, a new challenger emerges: Papa John’s.

The battle for pizza dominance is far from over, but the fight has taken on a different meaning for Monaghan. Success is no longer just about winning the market but finding redemption.

The Anatomy of Innovation

It’s a humid summer night in 1984, Jeffersonville, Indiana. In a silent strip mall, a homeless man shifts restlessly on a bench, jolted awake by rustling. The source seems to be a dumpster a few feet away. “Raccoons,” he mutters, annoyed at the unwelcome disturbance. Suddenly, a pizza box flies out of the trash, landing near his feet. Startled, he cautiously peers into the dumpster.

From within the shadows, a young man in his twenties emerges triumphantly, a garbage bag in hand. His curly black hair is dusted with grated cheese, and smears of sauce streak his white T-shirt. “Got it!” he exclaims, unaware of his audience until their eyes meet. “What are you doing in there?” the man on the bench asks warily.

The answer is audacious. The bag has hundreds of discarded Domino’s order slips with customer names and addresses. By morning, those same customers will receive letters offering 50% off at a new pizza joint. That joint is Papa John’s, and the man behind the dumpster is its founder, John Schnatter. What began as a broom closet in a struggling bar is about to become the newest player in America’s pizza wars, fueled by ingenuity and a willingness to scavenge the competition’s scraps.

Schnatter’s guerilla marketing marks the first tremor in what will become a seismic shift in the pizza industry. For years, the battle for dominance was essentially a duel between Pizza Hut and Domino’s. A wave of challengers, armed with new recipes, bold ideas, and sophisticated strategies, is poised to rewrite the rules.

By the early 1990s, the stakes in the pizza game were higher than ever. December 1993 brought a harsh reckoning for Domino’s when a Missouri court handed down a $78 million judgment against the company. The lawsuit, from a car accident involving a Domino’s driver, alleged that the company’s 30-minute delivery guarantee encouraged unsafe driving.

Domino’s founder, Tom Monaghan, is livid in a boardroom in Ann Arbor, Michigan. “This is absurd!” he declares, slamming a hand on the table. “We don’t tell anyone to drive recklessly. We’re fast because our process is efficient.”

Ed Pair, Domino’s chief counsel, remains calm but firm. “Tom, it’s not about what we intend, it’s about perception. Every claim we face hinges on this guarantee. Without it, we stand a chance at weathering the storm.”

Monaghan’s eyes narrow as he listens to his executives argue. The 30-minute guarantee had been Domino’s crown jewel for decades, transforming it from a regional chain into a household name. Abandoning it feels like a betrayal of the company’s ethos. But Monaghan is pragmatic when he needs to be. After a tense pause, he gives the order. “Fine. Drop it.”

The loss of the 30-minute promise is a blow to Domino’s identity. Worse still, it comes at a time when Papa John’s is emerging as a credible threat. By 1994, the upstart chain opened 200 stores yearly, touting a commitment to “Better Ingredients, Better Pizza.” Schnatter’s strategy focuses on perfecting quality over speed, and it’s working. Customers rave about the buttery garlic dipping sauce and meticulously crafted crusts. Even Pizza Hut’s co-founder Frank Carney, lured back into the pizza business after years on the sidelines, buys a Papa John’s franchise.

While Domino’s grapples with public relations nightmares and rising competition, Pizza Hut is orchestrating a bold reinvention. In early 1995, the chain unveiled its latest innovation: stuffed crust pizza. Developed after years of trial and error, the concept is simple yet revolutionary, cheese baked directly into the crust. The goal is to turn the least-loved part of the pizza into its crowning feature.

But early tests are disappointing. Focus groups express scepticism, and sales in test markets fall flat. Determined to salvage the campaign, Pizza Hut’s advertising agency pitches a daring concept: a commercial featuring Donald and Ivana Trump, capitalising on their notorious divorce. Against all odds, both agree.

The ad airs nationwide, showing the estranged couple feigning reconciliation over a slice of stuffed crust. “It’s wrong, isn’t it?” Ivana says, taking a bite. “But it feels so right,” Donald replies. The stunt is a sensation, and stuffed crust pizza becomes an instant hit, adding $1 billion to Pizza Hut’s sales that year.

Flush with confidence, Pizza Hut doubles down on innovation. The chain introduces creations like the Triple Decker, featuring layers of cheese sandwiched between crusts, and the Edge, a pizza with toppings extending to the rim. Each product pushes the boundaries of pizza, reinforcing Pizza Hut’s dominance as an innovator in the field.

Due to all their differences, the three major players, Pizza Hut, Domino’s, and Papa John’s, share one unifying challenge as the 21st century looms: the rise of the internet. In the early 2000s, online ordering was still a novelty, but its potential is undeniable. Pizza Hut pioneered the space with PizzaNet, a rudimentary platform launched in 1994. By 2005, both Pizza Hut and Papa John’s were reaping the rewards of e-commerce, while Domino’s lagged.

Then, in 2008, Domino’s unveiled its answer: the Pizza Tracker. For the first time, customers can watch the progress of their order in real-time, from preparation to delivery. The feature, hailed as a game-changer, repositions Domino’s as a tech-savvy leader. Yet the digital arms race is far from over.

The pizza wars are no longer confined to kitchens and delivery routes. They’re battles fought in boardrooms, courts, and the vast expanse of cyberspace. As the players evolve, so do the stakes. The question is no longer just who makes the best pizza, who can anticipate the next significant shift in how customers want to experience it.

From Ashes to Innovation

It’s April 2009 at Domino’s headquarters in Ann Arbor, Michigan. Tim McIntyre, the company’s vice president of communications, sits at his desk, cradling his morning coffee as he scrolls through emails. One message catches his eye, sent by a sharp-eyed blogger. “You might want to see this,” it reads, accompanied by a YouTube link. McIntyre clicks it, and his jaw tightens as the video begins.

The shaky footage shows two Domino’s employees in uniform, horsing around in a kitchen. The scene turns grotesque: one worker sneezes on a cheese stick and smears it with his hands. The other mocks the act, laughing. McIntyre’s stomach churns. He glances at the view count, half a million, climbing by the second.

The video’s virality unleashes chaos. Still in its infancy, the social media team is quickly overwhelmed by outrage. McIntyre scrambles to contact YouTube, demanding the video’s removal, while issuing directives to security and senior management. Within hours, the offending store is located in Conover, North Carolina, and the two culprits are fired. Domino’s executives breathed a small sigh of relief upon learning that the contaminated food had never left the store. But McIntyre knows the damage is done.

In the age of social media, silence equals complicity. McIntyre makes a bold decision: Domino’s will respond directly, launch its social media accounts immediately, and address the backlash head-on. “We need to show that we’re not just a company, but people who care,” he says. He ropes in company president Patrick Doyle, who records a video message that day, apologising to customers and assuring them of corrective actions. “We’re taking this seriously,” Doyle promises. “This is not who we are.”

The video calms some storms, but a more profound problem festers beneath the surface. Online comments frequently deride Domino’s food, likening its crust to cardboard and its sauce to ketchup. Preparing to ascend as CEO, Doyle knows the company’s reputation has become its most significant liability. “This isn’t just a PR crisis,” he admits privately to his team. “It’s an existential one.”

In the months that follow, Doyle embarks on a bold experiment. At a strategy meeting, a market researcher shares a grim finding: Domino’s is ranked lowest among national pizza chains for food quality. Doyle grimaces when she adds, “People like our convenience, but when they know it’s Domino’s pizza, they rate it worse.”

The revelation stings, but it’s hardly news to Doyle. He’s felt the sting during casual gatherings when friends shy away from suggesting Domino’s. As CEO, the responsibility for change falls squarely on his shoulders.

“This isn’t something we can fix with a few tweaks,” Doyle declares. “We need to start over.”

His team proposes an audacious plan: admit publicly that Domino’s pizza hasn’t been good enough and unveil a wholly revamped recipe. The idea is bold, risky even. If it fails, Domino’s could lose the trust of its few loyal customers. But Doyle is resolute. “Let’s tell the truth,” he says. “Let’s own it.”

In December 2009, Domino’s launched “Pizza Turnaround,” a campaign redefining corporate America transparency. Television ads feature customers reading brutal critiques of the old pizza. Domino’s executives appear on-screen, candidly acknowledging the failures and promising change. “We heard you,” one ad declares. “And we’re doing something about it.”

The campaign resonates. Coupled with a new recipe and an innovative money-back guarantee, sales soar. By early 2010, demand for Domino’s pizza was so high that the chain nearly ran out of pepperoni. Analysts, initially sceptical, are floored by the 14% jump in U.S. sales during the first quarter of 2010.

Yet, Doyle isn’t finished. He pushes the company further into transparency, ending staged food photography in advertising. Instead, Domino’s showcases photos submitted by actual customers. The company even turns a Times Square billboard into a live Twitter feed, displaying unfiltered feedback, both praise and criticism.

The transformation is nothing short of remarkable. By 2011, Domino’s was the darling of the fast-food industry, proving that even a tarnished brand can be salvaged with honesty, humility, and innovation.

But while Domino’s thrives, its competitors face mounting challenges. Pizza Hut, once the undisputed leader, struggles to modernise. The iconic red-roofed restaurants, a symbol of family dining in the 1980s, are now viewed as outdated relics. New competitors, from Papa John’s to fast-casual chains like Blaze Pizza, chip away at its market share.

In 2014, Pizza Hut launched “The Flavor of Now,” a menu overhaul featuring artisanal crusts, bold sauces, and trendy toppings like honey Sriracha. The campaign is a calculated gamble to lure adventurous eaters. However, the campaign lands with a thud. The new offerings boost sales by just 1%, a poor return on the millions invested in rebranding and retraining.

Meanwhile, Domino’s possesses its technological advantage. By 2015, the company had offered orders via Twitter, Amazon Alexa, and even smartwatches. Its Pizza Tracker app introduced years earlier, evolved to include GPS delivery tracking. The innovations solidify Domino’s position as a leader in pizza and convenience.

By 2017, the results are undeniable. Domino’s overtakes Pizza Hut in global sales for the first time, ending its rival’s decades-long reign. It’s a triumph built on a foundation of self-awareness and adaptability. Domino’s had the humility to admit its shortcomings and the courage to reinvent itself.

For Doyle, the journey has been vindicating. “We didn’t just rebuild a pizza,” he reflects. “We rebuilt trust.” The lesson is clear: in business, as in life, the willingness to confront failure often paves the way for success.

Shifting Slices

The battle between Pizza Hut and Domino’s was never merely about pizza. It was a tale of adaptation, innovation, and survival in a landscape shaped by shifting consumer tastes and technological revolutions. By the late 2010s, this contest had entered a critical phase, one defined as much by delivery apps and digital footprints as by cheese and crusts.

For decades, Pizza Hut was America’s undisputed pizza king. Its iconic red-roofed restaurants, complete with jukeboxes and salad bars, were cultural landmarks, where families gathered after little league games and teenagers lingered over pepperoni slices. But by 2020, these symbols of mid-century dining were liabilities. Domino’s, lean and digitally savvy, had sprinted past Pizza Hut in global sales for the first time in 2018, and the gap was only widening.

Pizza Hut’s decline was not due to a lack of effort. Under the stewardship of Yum Brands, the world’s largest restaurant operator, Pizza Hut, had poured resources into modernisation. Its “Flavor of Now” menu, introduced in 2014, was an ambitious overhaul that offered diners an overwhelming array of crusts, sauces, and toppings. The idea was straightforward: variety would draw customers back to the fold. But the results were underwhelming. While Domino’s surged ahead with its simplified, tech-first approach, Pizza Hut’s multi-million-dollar initiative barely moved the needle.

Part of the issue lies in identity. With its long-standing dine-in legacy, Pizza Hut needed help pivoting fully to delivery and carryout. Its vast network of sprawling restaurants, once a cornerstone of its success, now represented an Achilles’ heel. These large buildings were expensive to maintain, and their relevance dwindled in a world where convenience reigned supreme.

The problem began in 2020 when one of Pizza Hut’s largest franchisees, NPC International, filed for bankruptcy. Among its holdings were over 1,200 Pizza Hut locations, and the restructuring led to the closure of more than 300 underperforming stores. Analysts pointed to a clear trend: Pizza Hut’s failure to adapt quickly enough to the rising delivery dominance.

By contrast, Domino’s had spent the better two decades reengineering its business model around speed, value, and technology. In 2009, it boldly admitted that its pizza “sucked” and introduced a revamped recipe. The transparency struck a chord, catapulting the company to new heights. Over the next decade, Domino’s doubled down on digital innovation. Its app became a case study in seamless e-commerce, allowing customers to track their pizza from preparation to delivery. Its “Pizza Tracker” was a game-changer, turning a mundane wait into a real-time experience.

More crucially, Domino’s rejected the lure of third-party delivery services like Uber Eats and DoorDash, a decision that baffled some industry observers. While competitors partnered with these platforms to broaden their reach, Domino’s saw a different path. It maintained control over its brand and margins by investing in its fleet of drivers and delivery infrastructure. The move paid off. Customers associated Domino’s with reliability, while competitors grappled with the reputational risks and costs of third-party delivery mishaps.

Domino’s also introduced a “ fortressing “ concept, opening multiple locations in the same area to reduce delivery times. While controversial among franchisees worried about cannibalising sales, the strategy cemented the brand’s reputation for speed. In an age of instant gratification, Domino’s was delivering not just pizzas but a promise of efficiency.

As the pandemic unfolded in 2020, the gulf between the two rivals widened. Domino’s, built for delivery, thrived amid lockdowns. Its streamlined operations and digital infrastructure enabled it to seamlessly handle the surge in demand. Sales soared, further solidifying its lead.

Pizza Hut, meanwhile, scrambled to adapt. Its reliance on third-party delivery partnerships was a double-edged sword, offering a quick solution but eroding profit margins. Moreover, many of its dine-in locations needed to be equipped for the off-premises pivot that became essential during the crisis.

Yum Brands recognised the stakes and began to recalibrate Pizza Hut’s strategy. The company scaled back its dine-in footprint, focusing instead on delivery and carryout. By 2021, it had introduced innovations such as GPS-enabled delivery tracking and enhanced its digital ordering capabilities. Yet, catching up with Domino’s would require more than incremental improvements, it demanded reimagining what Pizza Hut stood for.

Pizza Hut and Domino’s rivalry has always been more than a battle for market share. It’s a study of corporate agility and the power of foresight. Domino’s success lies in its willingness to confront uncomfortable truths, whether about the quality of its product or the demands of a digital-first world. On the other hand, Pizza Hut serves as a cautionary tale about the perils of resting on legacy.

As the 2020s unfold, the pizza wars are far from over. The rise of ghost kitchens, drones, and autonomous delivery vehicles promises to reshape the landscape yet again. For Pizza Hut, the challenge will be to shed its nostalgia and embrace innovation at the speed of its competitors. For Domino’s, the goal is to maintain its edge while navigating the same technological disruptions.

Ultimately, the contest between these two giants is about more than pizza. It’s a reminder that evolution is not optional in business, it’s essential.

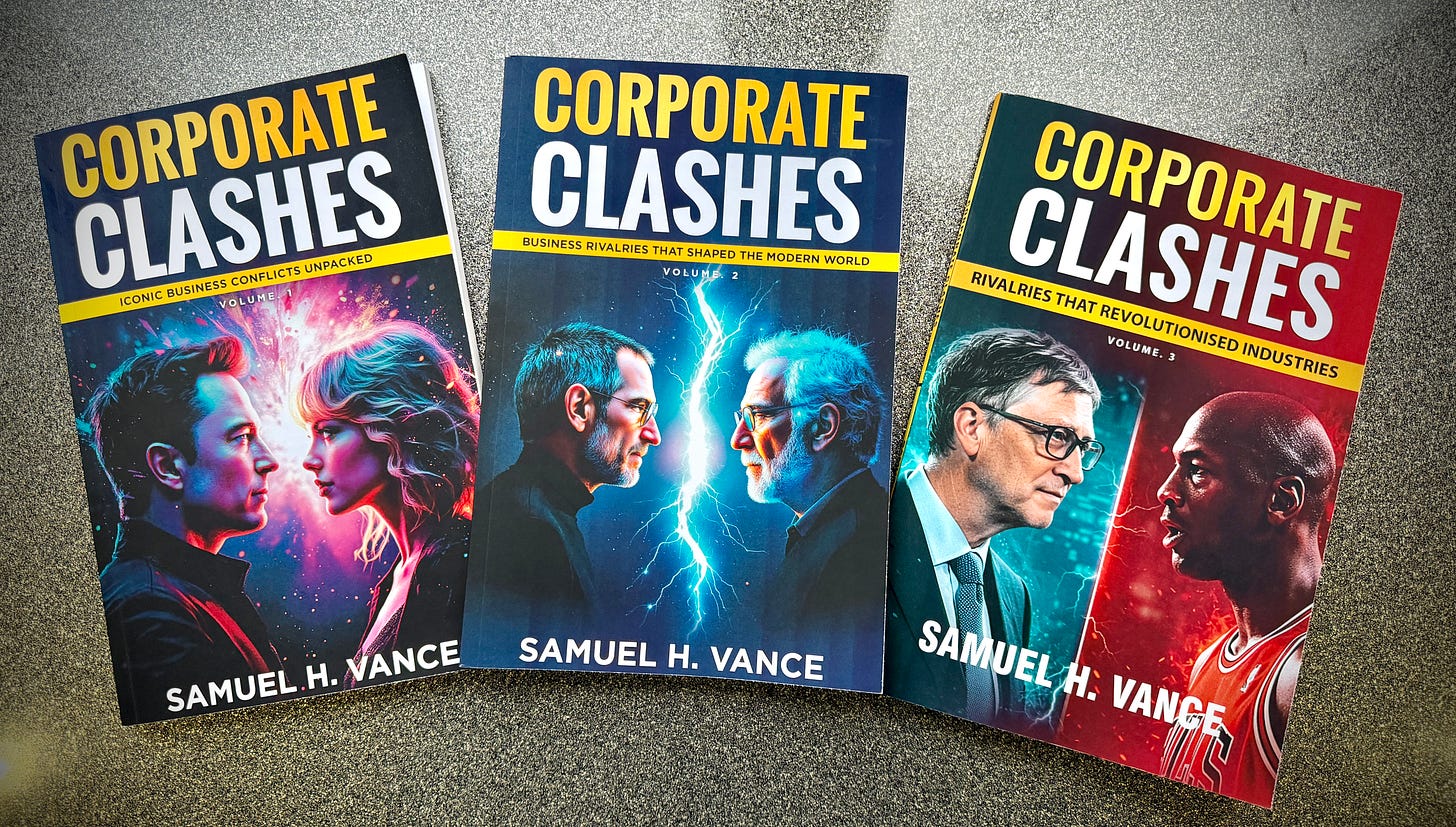

Corporate Clashes Series by Samuel H. Vance

‘Pizza Hut and Domino’s: A Clash of Crusts’ is a serialised extract from Samuel H. Vance’s Corporate Clashes series of books.